Tons of links (actually 260) again to go through.. seems that every second day there has been something notable.

Things didn’t go smoothly since my last post. 20 days later, Russia attacked Ukraine.

War and Inflation

Then Ukraine quickly got crypto donations worth tens of millions of dollars. Soon after that, the Western countries started to worry that Russia could evade their sanctions by using crypto, but it was totally unfounded. Scale, transparency, and unprepared financial structures would not make it possible and/or feasible. Anyway, that got this point up to public discussion and several Western administrations started to tighten the rules for crypto markets. At the same time, the collapse of several crypto companies boosted this too. More about that further below.

Soon Western countries were seizing assets of Russian Central Bank. This is a very notable action that will increase globally the need to get rid of the dollar economy (a bit later Malaysia took that issue up; What country would like others to have a possibility to seize their money?). The most likely candidate for that is some sort of digital money that would come very close to cryptos… But no more about that this time.

War and the following sanctions started to rise the prices everywhere. Food, oil, gas, etc. Central banks started to raise interest rates to fight inflation. Speculative loan money started to disappear from the market when there was no anymore free Covid money (interest rate zero or below) available and all assets sunk. Most affected were those that had the highest future prices discounted in the price. There were many hot technology stocks like Tesla (sunk 72%), Klarna (sunk 85%), Paypal (sunk 64%), and Bitcoin (sunk 77%).

Collapse of prominent crypto companies

On the crypto side rapidly decreasing valuations lead to the collapse of several big actors. Before those, there was though a big (625 Million dollars) gaming company Axie Infinity that got hacked (Axie Infinity was hugely popular game which economy was blockchain based). Next was TerraUSD/LUNA collapse that wiped out 60 billion dollars from the market. That led to the collapse of crypto hedge fund Three Arrows Capital (3AC) and cryptocurrency investment firm Voyager Digital once 3AC could not pay its loan back. Those two companies were worth 1 to 10 billion dollars and connected to many other crypto projects. Then went down Celsius which had liabilities of more than 6 billion dollars. At this point was the market bottom. Around this time also Director of global macro of Fidelity argued that Bitcoin was oversold, with good historical data.

About half a year later, it was the biggest US-based crypto exchange FTX, with a peak valuation of 40 billion dollars, that collapsed. The last one was a crypto lender BlockFI that was dependent on an FTX loan. BlockFI was valuated to 5 billion dollars. So, about 100 Billion dollars were wiped off in the year 2022. Especially the collapse of FTX got also SEC to enforce previously unclear rules. (Perhaps because the head of the SEC had a more close relation to FTX and then it collapsed in front of his nose.)

SEC has been reluctant to give any guidance for crypto companies, but just insisted that all (except Bitcoin, and perhaps Ethereum) are unregistered securities. However, that view got some setback as federal judge ruled that it was not the case with Ripple Lap’s XRP token.

Crypto coins’ plummeted valuation, the collapse of some big companies and the SEC’s aggressive enforcement of regulation has got crypto venture capital companies to decrease investments to 20% from the peaks. This might look very bad for Bitcoin, but under the thunder of bad news (in the Western world), the value has been rising again. Adaptation has been also going forward all the time. Even the VC money in Asia has not been scared.

Crypto coins’ plummeted valuation, the collapse of some big companies and the SEC’s aggressive enforcement of regulation has got crypto venture capital companies to decrease investments to 20% from the peaks. This might look very bad for Bitcoin, but under the thunder of bad news (in the Western world), the value has been rising again. Adaptation has been also going forward all the time. Even the VC money in Asia has not been scared.

So, at the same time

- Bitcoin is now trading near 30K USD and has already rebounded almost 90% from last year’s bottom.

- Bitcoin hash rate and mining difficulty is at all-time peaks.

- Despite all the setbacks, over 8 trillion dollars’ worth of transactions were done in Bitcoin blockchain in the year 2022. It is only half from the previous year, but double over the year before.

- Bitcoin becomes official currency in Central African Republic

- As Chainanalysis says: “Bear markets can’t wipe out bull market adoption”.

Money and it’s transfer is in a big change

According to Ripples’ survey, 97% of respondents believed that cryptocurrency and blockchain tech would have a significant role in enabling faster payments in the next three years. More than 50% of surveyed payment executives believe that most merchants will accept crypto payments within one to three years.

Master Card CEO says that Swift probably won’t exist in 5 years. (Swift stands for “Society for Worldwide Interbank Financial Telecommunication” and is the network that moves money between Banks in different countries)

There are twice the number of crypto investors in Indonesia compared to traditional stock investors.

Central Bank digital currency

Central Bank digital currency (CBDC) is a hot topic, with over 100 countries investigating central bank currencies. Here is a nice snapshot image from CoinTelegraph and the latest state can be checked directly from cbdctracker.org.

and the latest state can be checked directly from cbdctracker.org.

China is leading on CBDC side. It has already processed 250 billion dollars’ worth of their digital yuan (e-CNY). It is being piloted in at least 26 provinces and cities across the country and is supported by Alipay and WeChat Pay, two of China’s largest online payment platforms. 70% growth from last year August. It is also piloted in Hong Kong so that tourists from the mainland can use it.

3rd world needs it

World Bank released a report from which Cointelegraph made a chart that shows how many unbanked people there are (who would directly benefit from Bitcoin).

World Bank released a report from which Cointelegraph made a chart that shows how many unbanked people there are (who would directly benefit from Bitcoin).

..and where it is used

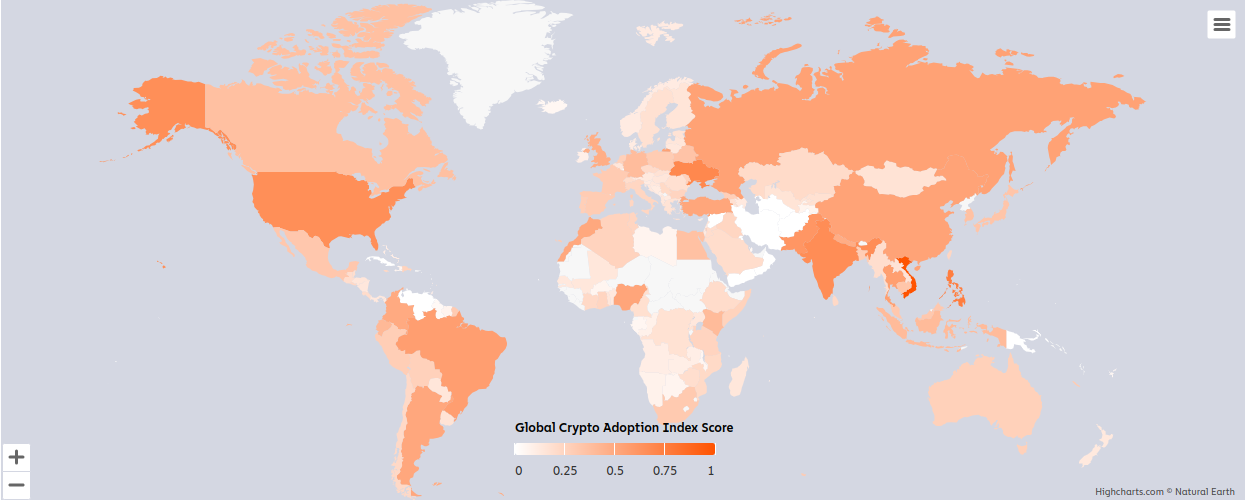

Above, a chart from Chainanalysis shows where cryptos are most used around the world. Darker orange means that it is used more. Vietnam is leading for the second year in a row!

Lightning

Lightning is the second-level layer on the Bitcoin network that will be able to handle much more transactions (around 1 million per second) and much faster (around in a second), without any additional energy consumption. Some first runners (like CashApp) have improved their offering. Many prominent exchanges (Bitfinex, Kraken, River Financial, OKX, CoinCorner, and Binance) have integrated to Lightning network, and also Coinbase, Robinhood (16Million MAU*), Subway (37K restaurants; Subway is the largest fast food franchise in the world currently), Groupo Salinas (which own tens of businesses in Mexico), and PayPal are doing it right now.

Capacity of the Lightning Network has also grown quite nicely – 50% from the last year.

If you want to be on the cutting edge, the wallet of satoshi is a good first option, before moving to non-custodial wallets like Muun or Breez

* MAU = Monthly active users

Investors have an appetite for Bitcoins

Nomura (Japan’s largest investment bank and brokerage group; AUM** 0.5 Trillion USD) released its survey results after polling more than 300 institutional investors with collective assets worth $4.9 trillion. According to them:

- Professional investors are still keen on crypto but want to see backing from large traditional financial institutions

- 96% of them regarded digital assets as “representing an investment diversification opportunity”

- 82% of the professional investors interviewed were optimistic about the crypto asset class in general over the next 12 months.

Another survey from Nasdaq said that 72% of 500 financial advisers would be more likely to invest their clients’ assets in cryptocurrency should the SEC approve a spot crypto ETF product in the United States.

** AUM Asset under management

Traditional finance is going there

Big Banks

And that is what the traditional banks are doing. Germany’s largest banking institution, Deutsche Bank (0.8 Trillion AUM), applied for a digital asset custody license, as well as the Commerzbank (AUM 0.5 Trillion EUR). Smaller Banks in Germany are also following suit. Here is a good (but quite long) article about how Banks in Germany are providing access to cryptos at the moment. (TL;DR; Only very small banks offer it now. The big ones are just coming in.)

Societe General (3rd biggest Bank in France) has also received the license recently.

Investment companies

BlackRock (the world’s biggest asset manager, AUM 8.6 Trillion USD) has filed an application for Bitcoin ETF and some believe that it will be a huge approval for Bitcoin as well as making investments to Bitcoin easier for institutions and Banks. BlackRock is joining the list of other financial companies that have done the same: ARK Invest, Grayscale, Galaxy Digital, VanEck, Valkyrie Investments, NYDIG, SkyBridge, WisdomTree and Fidelity (AUM 4.5 Trillion USD). All those companies are now confident that they will get it. The deadline for SEC to give some answer for ARK Investment’s application is on 2023-08-13, and SEC can delay it by at most 240 days, in case it doesn’t approve or reject it at once. Grayscale has asked that all Bitcoin ETFs would be accepted at the same time to avoid one having an advantage over the others.

New VC money is also coming to market for the Institutional demand.

Looking back and forward

Since my previous update, cryptocurrency users have also reached 400 million according to Triple A. Value transfer was exceeded, but the price hasn’t gone up (yet :). Volatility was high when the price came down, but lately, the price has been very stable. Since there hasn’t been much room for speculation (due to low volatility), the market has been sucking all the Bitcoins that miners have been selling to keep their business running. Currently, that means markets are buying in these levels monthly worth 0.8 billion dollars (Excluding any possible accumulation that miners might do). Once the traditional finance gets access to the market (e.g. after Bitcoin spot ETFs are accepted) it is expected that increased demand will drive the price up. (At the moment 15 top performing ETFs have exposure to cryptos.)

If the big investment companies that have applied for Bitcoin etfs would diversify their portfolios (combined AUM 20 Trillion) and allocate 1% (0.2 Trillion = 200 Billion) to cryptos it would mean that the demand would be multiplied by 250 times. Since there is only a small flow of new Bitcoins through mining and the number of Bitcoins is very limited (not much flexibility for price) the price can rise very quickly.

Never invest more than you can afford to lose, but 1% asset diversification might not be a bad idea.

Until next time!

Update 12.10.2023: Seems that others (CEO of Morgan Creek Capital and Senior Bloomberg analyst) have the same idea of the increased demand after spot ETF is accepted.